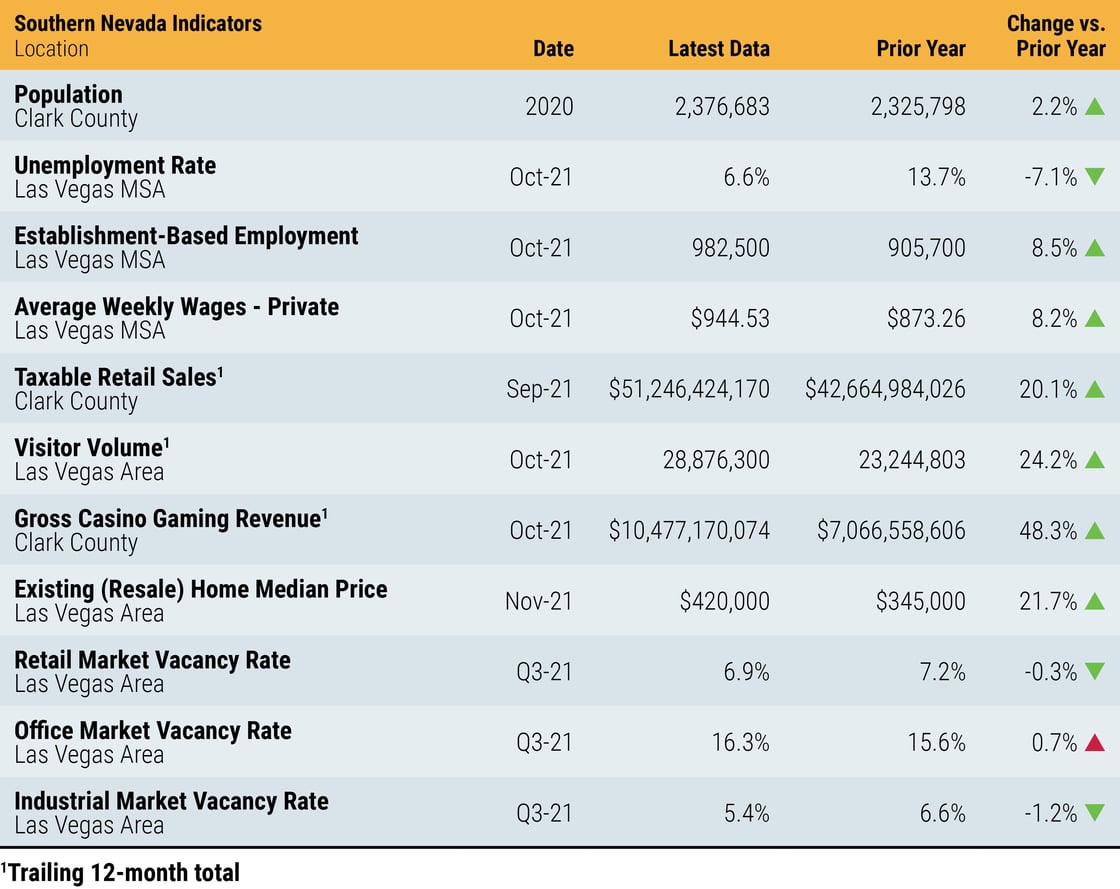

As 2021 comes to a close, Southern Nevada’s economy was edging closer to what it looked like prior to the widespread effects of the COVID-19 pandemic. Most major economic indicators continued to recover over the past few months, a positive sign that the coming year will be better than the past two.

Total employment recovered throughout the fall and into the winter months, rising to 982,500 in October 2021 (latest data available) for an 8.5 percent improvement from a year earlier. As of October, Southern Nevada had recovered 75.1 percent of jobs lost during the onset of the COVID-19 pandemic. In the big picture, Southern Nevada has recorded a month-over-month improvement in overall employment for nine consecutive months, averaging month-over-month gains of 1.0 percent. Meanwhile, the regional unemployment rate contracted to 6.6 percent in October, marking four consecutive months of improvement. The current unemployment rate was a 7.1 percentage-point improvement on the year and a 26.7 percentage-point improvement from the peak of the recession (April 2020). While the underlying improvement in the unemployment rate is welcome news, Southern Nevada held the second-highest unemployment rate among the nation’s large metro areas, with just Los Angeles recording a higher rate at 7.1 percent.

Job growth was observed across most industries in October 2021, as the leisure and hospitality sector lead the way with 29,900 jobs added over the year for a 15.1 percent growth rate. Meanwhile, the professional and business services sector added 19,400 jobs for a 14.6 percent year-over-year improvement. Other sectors that reported gains were the trade, transportation and utilities sector adding 16,200 positions (+8.6 percent), other services adding 6,200 jobs (+22.1 percent), education and health services gaining 4,400 positions (+4.2 percent), financial activities adding 2,100 positions (+4.1 percent), manufacturing gaining 800 jobs (+3.4 percent) and information adding 500 positions (+5.3 percent). The construction sector reported a loss of 300 jobs (-0.5 percent) and the government sector recorded a loss of 2,400 positions (-2.3 percent).

Tourism in Las Vegas briefly slowed in August and September before ramping up in October. A total of 3.4 million visitors came to Southern Nevada in October, an 82.6 percent increase on the year and the highest monthly total since the onset of the pandemic. Special events and related leisure travel continued to drive visitation. Passenger counts at Harry Reid International Airport mirrored this trend, as 4.2 million passengers passed through the gates in October, a 111.0 percent increase on the year. Meanwhile, the average daily room rate (ADR) jumped significantly to $173.68 in October, the highest in tracked history. The convention segment remained limited as it has through 2021, but many of the major conventions and trade shows are eyeing a return to Las Vegas in 2022, starting with the return of CES in January. Additionally, the U.S. ban on international travel was lifted in November, which should provide a boost for international visitation to Southern Nevada.

Southern Nevada’s gaming industry continued its hot streak into October 2021 with another billion-dollar month in gross gaming revenues. The $1.1 billion in gross gaming revenue collected in October marked a 57.3 percent increase on the year and was 9.1 percent behind the record-setting total of $1.2 billion in July 2021. October was also the fifth month of more than $1.0 billion in gross gaming revenue collections in the past six months. Gross gaming revenue on the Las Vegas Strip totaled $702.2 million in October, which marked an 86.9 percent improvement on the year. Meanwhile, gross gaming revenue in the Las Vegas locals market area was $222.5 million, a 16.1 percent improvement from last year but also the second consecutive month of declining revenue.

Southern Nevada’s housing market gained further momentum into the winter months. The median sales price for existing single family homes rose to a new high of $420,000 in November 2021, up 21.7 percent on the year. As of November, the median single family home price had climbed in 19 consecutive months. At the same time, sales volumes remained elevated compared to the pre-pandemic period, eclipsing 3,000 sales in all but two months in 2021. The factors that have driven the housing market through 2021 – including declining availability, record-low interest rates and strong in-migration metrics – are poised to carry into early 2022 and continue to push pricing upward.

Overall, there is a strong sense of optimism going into the new year. The housing market showed no signs of slowing down, employment grew steadily and the tourism industry is getting its footing once again. The success of 2022 hinges on the Southern Nevada economy’s ability to build upon the trends in the second half of 2021, including the continued recovery of the core tourism industry that is directly correlated to the widespread success of the economy. While Southern Nevada is tracking toward full recovery, we remain mindful of supply chain challenges, inflationary conditions and an evolving labor pool.